- #Turbotax 2015 home and business screenshot for free

- #Turbotax 2015 home and business screenshot upgrade

- #Turbotax 2015 home and business screenshot software

- #Turbotax 2015 home and business screenshot professional

#Turbotax 2015 home and business screenshot software

This bad boy gives your tax software provider permission to use your tax data to sell you stuff. This includes things like targeted credit card offers, Roth IRA offers, 401k offers, and hey how about a wonderful timeshare in Orlando Florida. If you give your tax preparer permission to use your data for other purposes they can do that. Rich personal and financial data? Shut up and take my money.Īnd what better treasure trove of data than your personal income tax data! Luckily the IRS had the foresight to nip this one in the bud: Section 7216 of the Internal Revenue Code sets up stipulations on what a tax preparer can do with with the information you provide them… namely they can use it only to prepare your taxes. Option 2: Use the customer’s data against them. This is particularly bad when they’re trusting you to help with a task they already want no part of. They stop believing the tax software has their back and start feeling like it’s a solar panel salesman. You know why I hate this strategy so much? Because when you’re doing this to a customer they start to become guarded. (pro tip: audit insurance is a lot like blackjack insurance). Oh, and don’t forget the audit insurance.

#Turbotax 2015 home and business screenshot upgrade

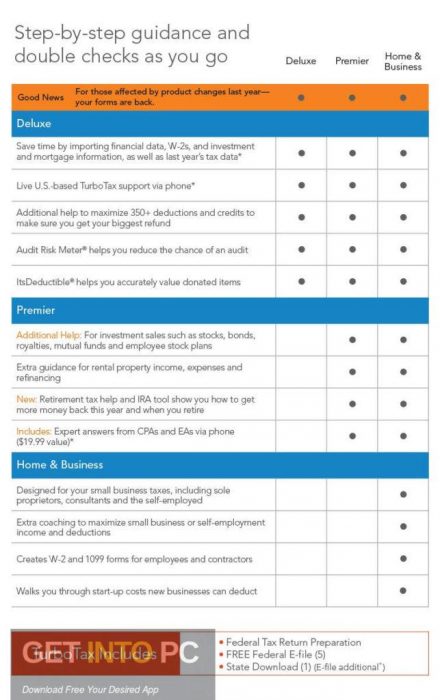

Ooooh, you sold a share of stock and made a $100 profit? Upgrade.Įven better, I’ll keep throwing upsell screens at you until you accidentally upgrade or get so concerned the free version isn’t trustworthy you upgrade just to make the nagging stop. Option 1: You get users in the door with free and then you upsell upsell upsell! Oh hey, you want extra guidance? You’ll need to upgrade. You have to squeeze the money out somehow and there are really only two viable options: So how do you pay those costs and give your software away for free? Obviously you can’t. Good engineers cost money, good interface designers cost money, and good insurance costs (a lot) of money. You have to figure out wording that is completely unambiguous despite the necessity of IRS language, which may be incredibly ambiguous.Īnd think about the liability! If you’ve got a bug that screws up one person’s tax return you’ve got a bug that screws up thousands of tax returns.

#Turbotax 2015 home and business screenshot professional

Sure, the math part of it is easy but you’ve got to make the interface dead simple (after all, everyone has to do their taxes not just professional computer jockeys). If it does affect you personally even worse the average time to resolve your case is 6 months and if you’re due a refund that’s a long time to wait.Ĭreating good tax software is hard. That may seem great at first blush if you qualify, but an unintended consequence is it’s now completely free for a fraudster to file a state tax return in addition to a federal one.Įven if this doesn’t affect you personally it creates a really expensive bill that’s footed by all taxpayers.

#Turbotax 2015 home and business screenshot for free

That’s right, a lot more people can file their state taxes for free using TurboTax’s software. What’s new this year besides a dramatic increase in state tax return fraud? TurboTax’s Absolute Zero campaign. The rise in federal tax return fraud has grown steadily in relation to the number of software providers offering a free option… the reason we haven’t seen state fraud as rampant is because historically it always cost money to prepare your state return with software. So what’s going on and why is TurboTax being called out by these states? State tax return fraud has been largely non-existent … so non-existent in fact that USA Today reported the state of Minnesota got suspicious when there were just 2 reported cases of fraud.įorbes went on to report that up to 18 states have noticed an uptick in fraudulent state filings – all with a common thread: tax preparation software. It’s a growing problem that the IRS is struggling to cope with and it’s been going on for years. They’ve since resumed e-filing of state returns and TurboTax announced there doesn’t appear to be breach of customers’ data, so what really went wrong?įederal tax return fraud is huge.

Intuit/TurboTax, one of the tax industry giants, suffered a black eye recently when they were forced to stop e-filing state tax returns for a period of time while they investigated a potential data breach.

0 kommentar(er)

0 kommentar(er)